24+ Weekly mortgage payments

2 hours agoThe current rate for a 30-year fixed-rate mortgage is 589 with 07 points paid an increase of 023 percentage points from a week ago. We suggest a 15-year fixed-rate conventional loan.

Free 24 Sample Payment Schedules In Pdf Ms Word

In this example choosing accelerated bi-weekly payments instead of monthly payments on a 150000 mortgage would save you more.

. The Bi-Weekly Mortgage Payment Plan is a convenient mortgage budgeting plan that can help you save thousands of dollars in interest and pay off your 30-Year Mortgage in only 24. For example you can take the amount of your monthly. 22 hours agoIf the borrower chooses a 30-year loan term theyll be making a monthly payment of 114580 including principal and interest insurance and other expenses are not included in.

Youll simply divide a regular monthly. Instead of having a biweekly mortgage company handle your monthly payment for a fee or having to make 26 payments a year. This method is mainly for those who receive their paycheck biweekly.

If you have a 300000 mortgage at 4 for 30 years biweekly payments will save you 35000 in interest payments. Bank Has Online Mortgage Calculators To Provide Helpful Customized Information. It also pays your loan early by 24 years and 6.

You can achieve similar or even better results by adding a small amount to your regular monthly payment. Your Payment Isnt Applied as You Pay. This week last year the 30-year rate.

Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. The principal and interest payment. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Bank Has The Tools For Your Mortgage Questions. When you pay biweekly you make a payment every other week.

This free mortgage tool includes principal and interest plus estimated taxes insurance PMI. Lets use a 250000 home with a 5 down payment and an interest rate of 45. Heres a clue.

Even though the payment is withdrawn from your bank account twice a month it isnt applied to your mortgage that way. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. An accelerated weekly mortgage payment is when your monthly mortgage payment is divided by four and the amount is withdrawn from your bank account every week.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. This makes two payments every month. If you make biweekly payments for the life of the loan once your mortgage is paid off you will have paid a total of 256288 on the loan and youll pay off your mortgage in 25.

With 12 months in a year youll be making 24 semi-monthly mortgage payments every year. Mortgage Calculator UK Home Price - Deposit - Mortgage Amount - Interest Rate - Term - Years Calculate Full Monthly Payment 78861 Interest Only 34350 Months 300 Total. With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage repayments during the year.

And heres another handy guideyoull know you can afford a mortgage if the monthly payments are no. Jul 2052 Loan pay-off date 30547814 Total Interest Paid 20000 Monthly Tax Paid 7200000 Total Tax Paid 8333 Monthly Home Insurance 3000000 Total Home Insurance 2424927. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage.

When you make a monthly payment you pay your mortgage 12 times per year or once a month. If you have a 200000 mortgage at 3 for 30 years. Weekly With this option you make 52 payments per year because there are 52 weeks in the year.

For example if your monthly mortgage payment is 1200 then if you want to do weekly payments the bank divides the monthly payment by four which means your weekly payment is 300. In this example adding 50 to your bi-weekly payments reduces your interest cost to 119177 saving you 41128 in total interest charges. Case Scenario Of Making Extra Monthly Mortgage Payments.

If you were to make two payments a month that would be just 24 payments in a year. To calculate this type you need to take your monthly payment х 12 times. Use our simple mortgage calculator to quickly estimate monthly payments for your new home.

You would pay 23313946 in interest over the life of the loan making the standard monthly payments. Simply take your normal monthly mortgage payment divide it by. If you switched to a biweekly plan you would pay only 18973444 in interest and.

So the biweekly method has you making two extra payments each year which is the.

How To Prepare Amortization Schedule In Excel With Pictures Amortization Schedule Daily Schedule Template Excel Templates

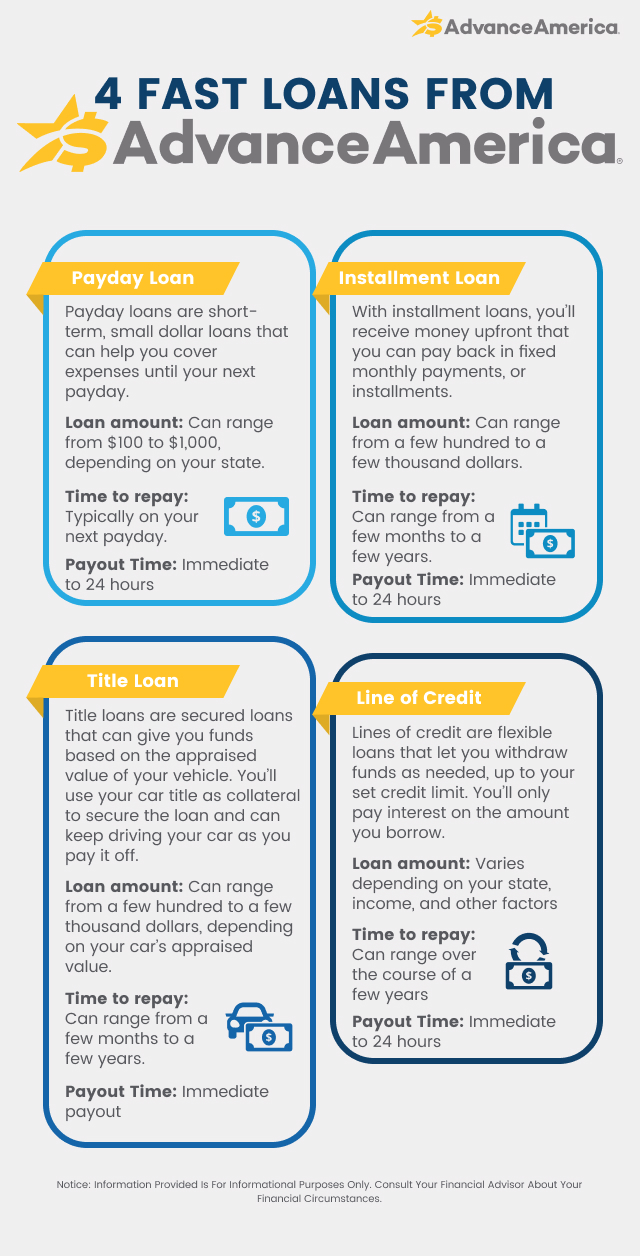

Installment Loans For Bad Credit Advance America

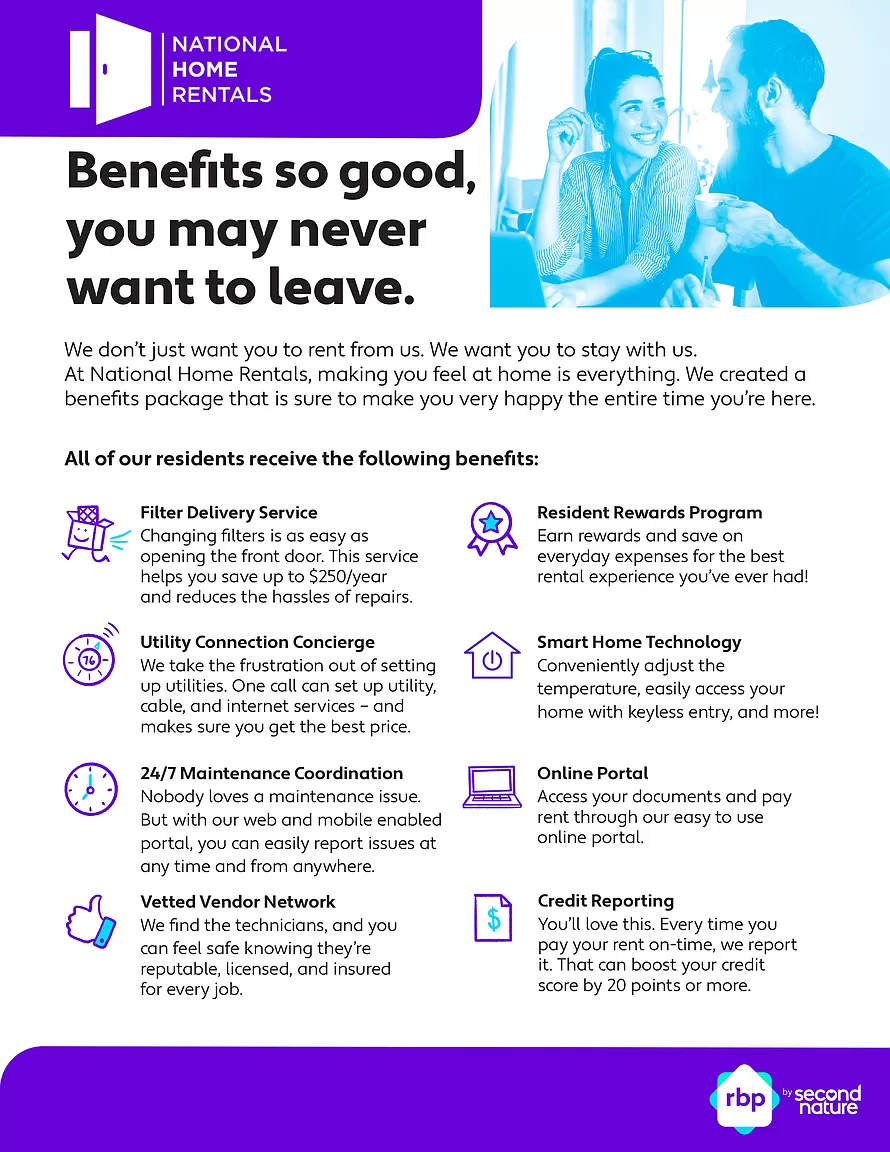

5 October Ave Newnan Ga 30265 Apartments For Rent Zillow

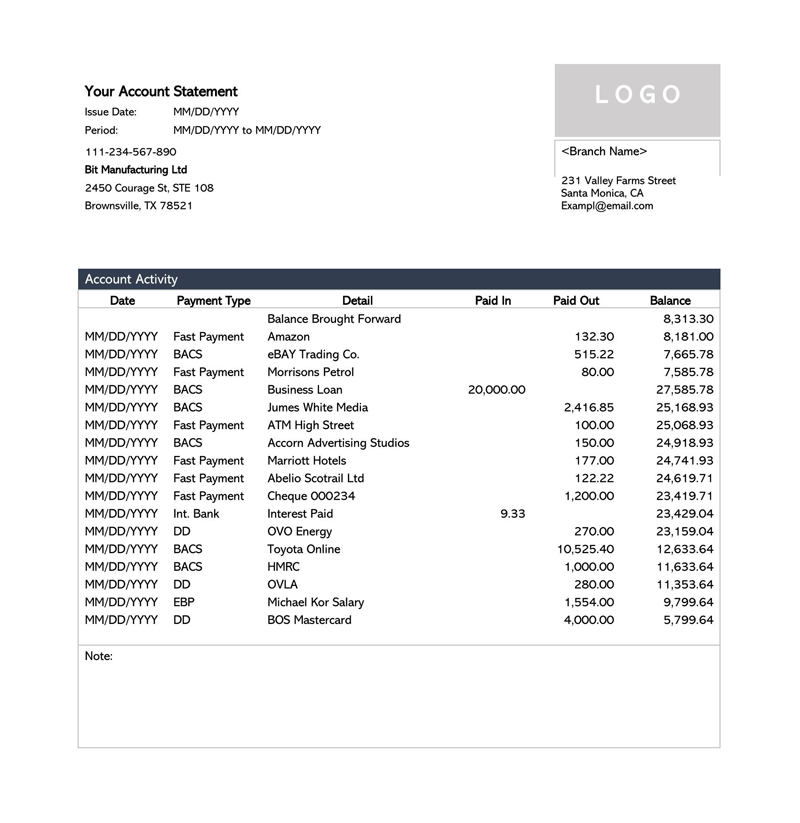

24 Free Personal Bank Statement Templates Word Excel

Sample Household Budget Worksheet Household Budget Template Budget Planner Template Budget Template Printable

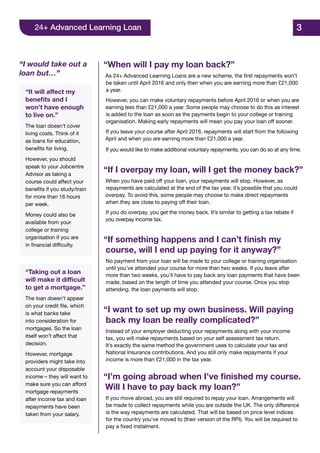

Faqs For Advanced Learning Loans Fe Loans

6164 Wheat Penny Ave Las Vegas Nv 89122 Apartments For Rent Zillow

Chilly S Water Bottle Stainless Steel And Reusable Leak Proof Sweat Free Pastel Coral 260ml Amazon C Bottle Water Bottle Stainless Steel Water Bottle

Best Collection Of Promissory Note Templates Word Templates Docs Notes Template Word Template Promissory Note

Contract Template Pdf 4 Things You Should Know Before Embarking On Contract Template Pdf Contract Template Free Word Document Contract Agreement

Free Invoice Templates 8 Printable Docs Xlsx Pdf Microsoft Word Invoice Template Invoice Template Word Invoice Template

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

How To Borrow Money Fast Money Loans Advance America

24 Total Compensation Statement Excel Template Statement Template Employee Benefit Excel Templates

Pin On Invoice Templates

Sample Daily Report 12 Documents In Pdf Word Report Template Word Template Words

How To Get Out Of Debt Pay Off Debt Or Save Advance America